How to diversify your portfolio

Embrace diverse investments

You need to spread out across different asset classes. Don’t put your eggs in one basket, as they say. Stocks, bonds, commodities, even unusual assets - get some of all of them. That way, even if a whole sector fails, you’ll still have your other investments.

Keep an eye on costs and fees

Do your math and do not invest more than you can afford to lose.

Stay engaged, don’t go on autopilot

Even if you’ve got a manager running your portfolio for you, or you’re invested in what is considered a sure-fire index, it’s still a good idea to check in with it once in a while, and if anything is not to your liking, you should do something about it. It’s your money! Set a regular check-in and rebalancing routine. It’ll give you peace of mind, and make your investments more profitable.

Step 7: Common mistakes to avoid

Beginners tend to make the same mistakes. So, if any of these seem familiar, it might be time to rethink your investment approach:

Ignoring fees and taxes — Hidden fees, such as expense ratios, trading commissions, and management fees, can eat into your returns over time. Choose low-cost index funds or ETFs, and always check the fees before investing.

Unrealistic expectations — Build a diversified portfolio based on your risk tolerance and goals. Don’t let others’ experiences shape your expectations, as market returns are unpredictable.

Overinvesting — Patience is key in investing. Frequent changes to your portfolio can incur costs and increase risks. Focus on learning about your current holdings instead of overreacting.

Getting swept up by media hype — Don’t let sensational headlines dictate your decisions. Conduct thorough research from reliable sources to inform your investments.

Chasing high yields — High-yield investments can be tempting, but remember that past performance is not indicative of future results. Focus on the overall picture and manage risk.

Timing the market — Market timing is challenging and often ineffective. Consistent contributions to your portfolio are typically more beneficial than trying to predict market movements.

Forgetting about inflation — Evaluate returns in real terms, considering inflation’s impact. What you can actually buy with your investment gains matters more than nominal returns.

Failing to start or stay invested — Don’t let fear or lack of knowledge stop you from investing. The greatest minds agree that success requires ongoing effort and a willingness to learn.

FAQ

How much money do I need to start investing?

The amount you start with depends on your goals, the type of investment, and how comfortable you feel. But generally, you don’t need a huge sum to start investing. At FBS, beginners can start investing with an initial deposit as low as $5. Plus, with leverage options, you can stretch that deposit significantly.

Should I invest in stocks, bonds, or mutual funds?

Beginners might want to focus on stocks because they have the potential for higher returns over time, plus it’s exciting and lets you own a share of companies you believe in. Bear in mind that they’re more volatile and carry more risk, so start with a few well-researched stocks. Bonds are a less risky and more conservative type of investment, suitable for supporting long-term financial goals. Mutual funds are a highly diversified basket of assets that are managed for you, and the risks are moderate.

How do I create a diversified investment portfolio?

Choose a mix of asset classes, including stocks, indices, forex, and commodities, to spread the risk. Within each asset class, select a variety of individual investments, like different sectors for stocks. Regularly check and adjust your portfolio to keep your ideal asset mix as markets shift.

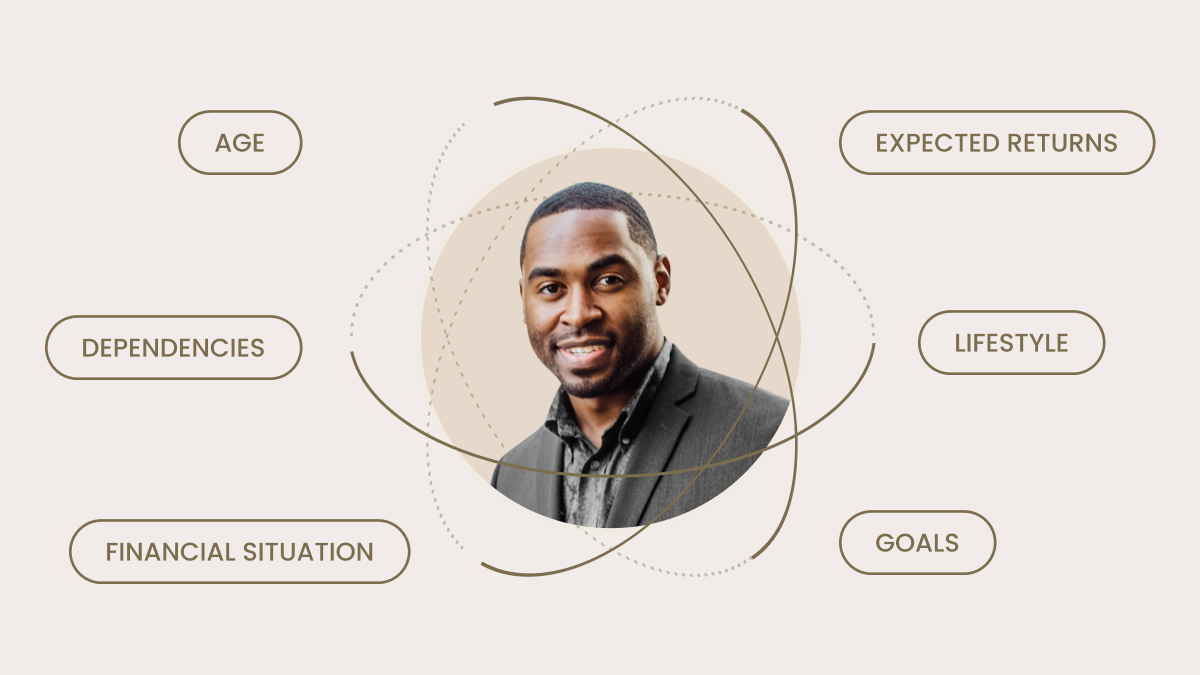

How do I choose the right investment strategy?

Consider your time horizon — how long you plan to invest before needing access to your funds. Longer horizons allow for more aggressive strategies. Evaluate your knowledge and experience with different investment types, and research various strategies, such as growth investing, value investing, or passive/active investing, to find one that goes with your objectives and comfort level.